Case Catalyst Archives

This case study, the first in the three-part series captures the various perspectives towards Slumdog Millionaire, which has invited much criticism for its audacious representation of poverty in India. This case study is primarily aimed at delving into many other such perspectives on the Danny Boyle-directed movie Slumdog Millionaire. While the movie has given oodles of hope and optimism for some to sustain even in the direst of the situations, for some others the movie has been nothing else but a reiteration of the age old perception of the West towards East. In the backdrop of the new and emerging hybrid model of Indian and western cinema, the case study explores issues such as – the collaborative journey of Indian cinema hand in glove with the Westerners, the factors that assisted in the corporatisation of the Indian cinema in the 21st century, the emerging trends in the global cinema industry, and finally the reactions of the various sections of the society towards Slumdog Millionaire. |

In February 2009, IBSCDC conducted video interviews with Maya Aoki, CEO of Health & Wealth International and Gurcharan Das, Former CEO of Procter & Gamble, India and author of the international bestseller, India Unbound.

In February 2009, IBSCDC conducted video interviews with Maya Aoki, CEO of Health & Wealth International and Gurcharan Das, Former CEO of Procter & Gamble, India and author of the international bestseller, India Unbound.

Maya Aoki’s video interview gives an insight into the entrepreneurial journey of an indomitable woman who weathered all the storms in her life with determination and turned it into a success in the male chauvinist world, achieving her own dreams and in turn helping many other women to realise their dreams under her proficient guidance.

Maya Aoki’s video interview gives an insight into the entrepreneurial journey of an indomitable woman who weathered all the storms in her life with determination and turned it into a success in the male chauvinist world, achieving her own dreams and in turn helping many other women to realise their dreams under her proficient guidance.

The Former CEO of Procter & Gamble India, Gurcharan Das, a management consultant and author of the international bestseller, India Unbound, shares his views quite candidly on a wide range of imperative issues, such as the future of Business education in India, need of CSR, Corporate Governance, India at 75 and its resilience in the wake of the current global crisis, reasoning how India can wade through the crisis unscathed.

The Former CEO of Procter & Gamble India, Gurcharan Das, a management consultant and author of the international bestseller, India Unbound, shares his views quite candidly on a wide range of imperative issues, such as the future of Business education in India, need of CSR, Corporate Governance, India at 75 and its resilience in the wake of the current global crisis, reasoning how India can wade through the crisis unscathed. |

||

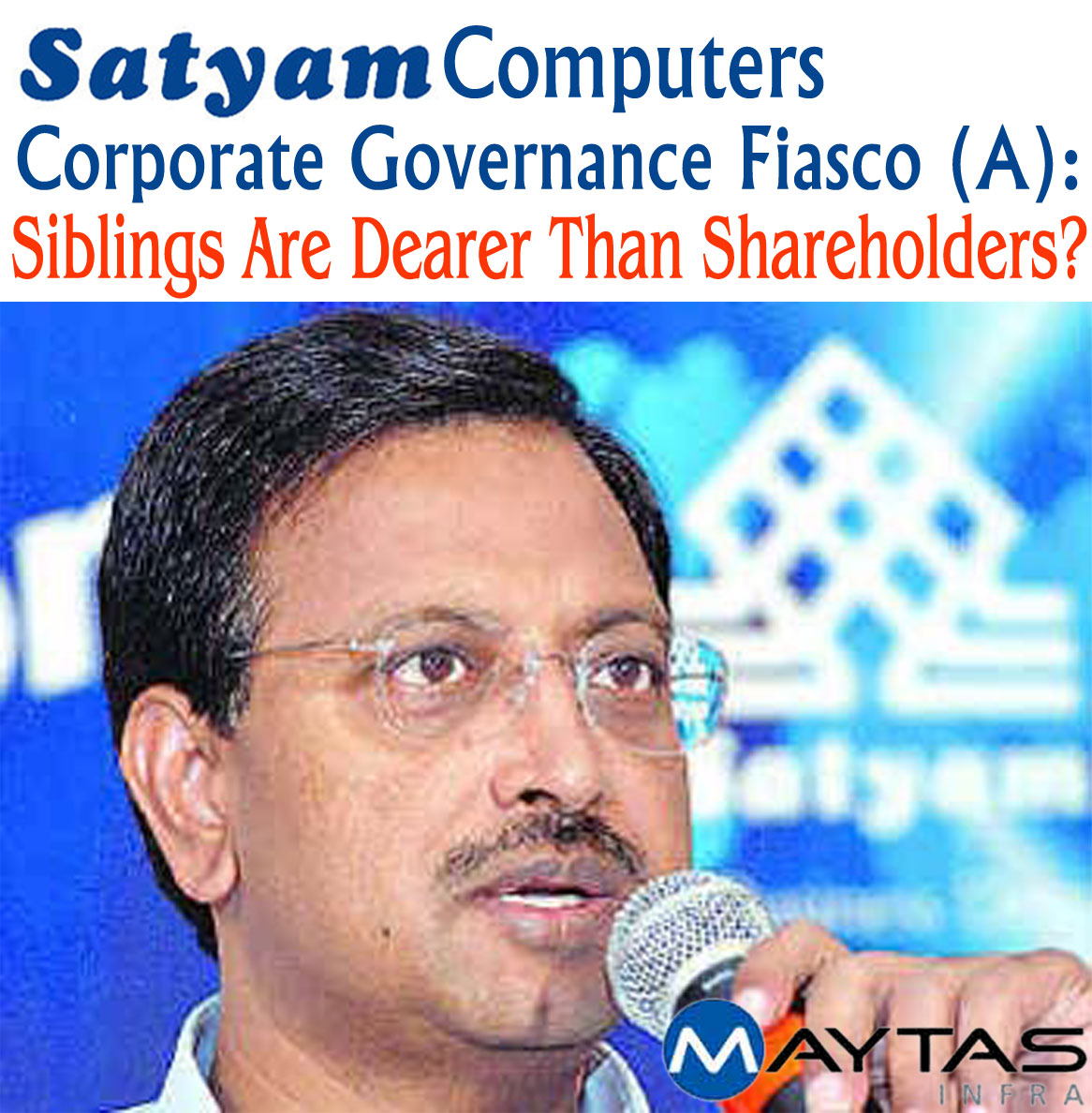

At the turn of events at Satyam Computer services, two important elements of a healthy corporate sector have come under spotlight: corporate governance framework, and the role of independent directors and auditors. Highlighting these aspects, our case study is a curtain raiser to Satyam’s corporate misgovernance. It captures the events that took place at Satyam after the Satyam-Maytas deal was struck (i.e. December 16th 2008– December 18th 2008) and chronicles the events as they had unfolded. What started as a routine business (board’s) affair, ended up in India’s Enron-like situation. While discussing the growth and success story of Satyam Computer Services, this case study portrays how Satyam lost its credibility that it has earned over the past two decades. Towards the end, it leaves intriguing issues like – the role of Maytas twins in the corporate governance fiasco, role of independent directors, role of shareholder activism, the larger fiduciary role of Board of Directors and the moral and ethical role of founder-CEO. | |||

Thanks to the shareholder activism, without which the biggest corporate governance fiasco in India would not have surfaced even till date. A sequel to Satyam Computers Corporate Governance Fiasco (A): Siblings Are Dearer Than Shareholders?, this case study inquires on the fiduciary duties of independent directors on Satyam board – the duty of loyalty to the shareholders and the duty of diligence in approving any proposals in the management of a firm. Debating on the role of the Board of Directors and the integrity of independent directors, this case study highlights the need to make corporate governance laws more effective to achieve more transparency and accountability. | |||

Highlighting the bankruptcy of Mervyns California, owned by a consortium of private equity firms, this case study addresses the flaws in private equity business model, as the strategies that worked well in the past seemed to lose their relevance. With majority of the companies (either owned or spun off by private equity firms) filing for bankruptcy, can the private equity firms be held responsible for the companies’ failure? Do these failures suggest that private equity firms need to restructure their business model? Will they be able to survive in the wake of the current financial crisis and the resulting credit squeeze? |

Slumdog Millionaire has been the surprise winner of the year 2008–2009. Much like the words of US President Barack Obama, “In the face of despair, you believe there can be hope”, this ‘rags-to-riches’ saga of a slum dweller spreads hope, optimism and courage to live amid the ongoing economic recession. The film, made with a modest budget, has even taught big film makers that a sensible and intelligent movie need not rely on big budgets and yet stand meritorious. Made by a British, the film portrayed by Indians and promoted by Americans connotes ‘cinema knows no barriers’. Business point of view, it is the recession that is driving Hollywood and alike from the West towards East in search of new market avenues. Above all, the movie captures the new emerging hybrid model in global cinema and strategic partnerships across various film industries. |

||

Does it make sense for a smaller player to operate in the most demanding and challenging environment to bolster its growth prospects even if it means operating within the vicinity of an established player? In the backdrop of Internet penetration in Russia and the presence of Yandex in the local search engine business, this case study presents interesting discussion on various issues – Yandex’s core competence against global players like Google, viability of its expansion into the US and above all analysing whether Yandex can win a slice of the market share in Google’s home ground. | |||

Is everything fair in business or the phrase is just a misnomer and an excuse at worst? This case study delves into how corruption remained a common factor across developed and developing countries irrespective of culture, history and geography, and its impact on global corporate world. It exemplifies Fluor Corp’s focus on anti-corruption initiatives and ethical business practices and how it made it to Ethisphere Magazine's list of ‘World’s Most Ethical Companies’ for two consecutive years (2007 and 2008). But in a highly corrupt industry like construction, can Fluor survive standing by its values? | |||

Good to Great: Why Some Companies Good to Great: Why Some CompaniesMake the Leap... and Others Don’t  “Can a good company become a great company and if so, how?” This question made Jim Collins (Collins), the author of Build to Last, explore ways in which successful organisations turned great producing sustainable results. He explored nearly 1,435 companies and finally settled down on 11 companies – Abbot Laboratories, Circuit City, Fannie Mae, Gillette, Kimberly-Clark, Kroger, Nucor, Philip Morris, Pitney Bowes, Walgreens and Wells Fargo. This book explores how Collins discovered common traits in these companies that challenged conventional ideas of corporate success and delves deep into concepts like level 5 leaders, hedgehog concept, culture of discipline, technology accelerators and the flywheel and the doom loop. Offering amazingly simple perspectives on running a business successfully, Collins suggests that transition from good to great does not require a high-profile CEO, the latest technology, innovative change management, or even a fine-tuned business strategy. It simply needs a corporate culture that promotes act in a disciplined manner. Illustrating a number of examples of great and not-so great companies, the book provides the right road map for corporate excellence. | |||

|

|||

|

| |||